Tips to Medicare to avoid fraud...

Do's

- Do protect your Medicare Number (on your Medicare card) and your Social Security Number (on your Social Security card). Treat your Medicare card like it's a credit card.

- Do ask questions. You have a right to know everything about your medical care including the costs billed to Medicare.

- Do educate yourself about Medicare. Know your rights and know what a provider can and can't bill to Medicare.

- Do use a calendar to record all of your doctor's appointments and what tests or X-rays you get. Then check your Medicare statements carefully to make sure you got each service listed and that all the details are correct. If you spend time in a hospital, make sure the admission date, discharge date, and diagnosis on your bill are correct.

- Do be wary of providers who tell you that the item or service isn't usually covered, but they "know how to bill Medicare" so Medicare will pay.

- Do report suspected instances of fraud.

Don'ts

- Don't allow anyone, except your doctor or other Medicare providers, to review your medical records or recommend services.

- Don't accept medical supplies from a door-to-door salesman. If someone comes to your door claiming to be from Medicare or Medicaid, remember that Medicare and Medicaid don't send representatives to your home to sell products or services.

- Don't be influenced by certain media advertising about your health. Many television and radio ads don't have your best interest at heart.

- Don't give your Medicare card, Medicare Number, Social Security card, or Social Security Number to anyone except your doctor or people you know should have it.

information excerpts from MediCare.gov

|

MD Department of Labor - Family and Medical Leave Insurance Below are some questions and answers if you are an Employer in the State of Maryland: What is family and medical leave insurance (FAMLI)? Family and medical leave insurance (FAMLI) will ensure eligible Maryland workers can take up to 12 weeks away from work to care for themselves or a family member and still receive income of up to $1000 a week. This program is often referred to as “paid family and medical leave” or simply “paid leave.” What qualifying events could a worker use leave for?- To welcome a child into their home, including through adoption and foster care

- To care for themselves, if they have a serious health condition

- To care for a family member’s serious health condition

- To make arrangements for a family member’s military deployment

Who will be able to receive paid family and medical leave benefits?Anyone who works at least 680 hours in a position based in Maryland over the previous four calendar quarters will be eligible for benefits.

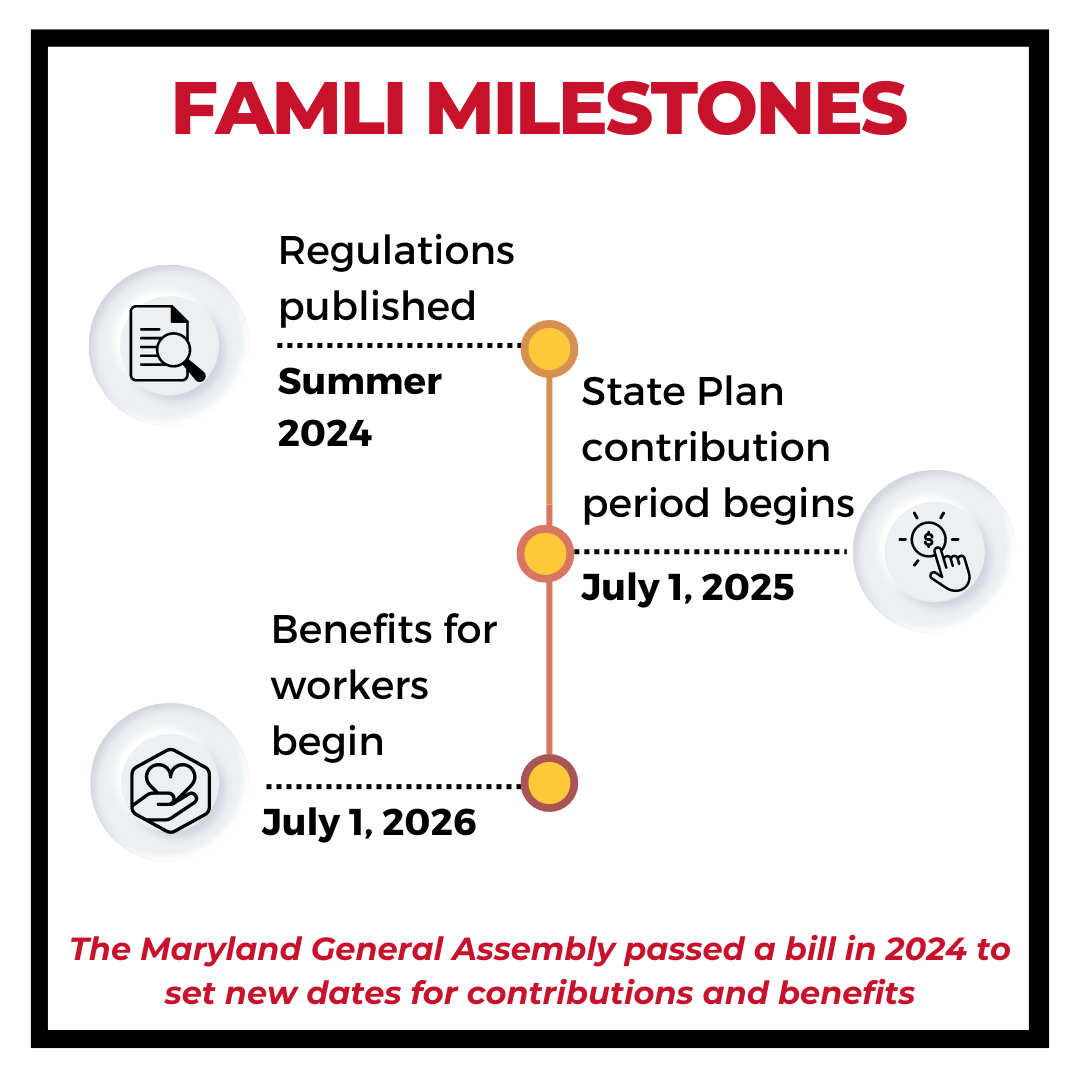

Will I be required to provide paid leave?Yes, all employers will be required to provide paid family and medical leave insurance. You may choose whether to provide insurance through the State Plan, a commercial plan, or a self-insured option. All employers with employees in Maryland, regardless of their paid leave coverage option, will be required to register with FAMLI in 2025. After registration, employers will be automatically enrolled into the State Plan administered by the Maryland Department of Labor, which will provide a seamless way to be in compliance. Alternatively, a business may apply to use a commercial or self-insured plan. More information about the selection process is forthcoming. Self-employed individuals can also elect to participate. How is FAMLI funded?FAMLI is funded through contributions that employers will remit to the State on a quarterly basis. The contribution amount is based on payroll. You may withhold up to 50% of the total contribution rate from your employees’ paychecks.  When will contributions begin? When will contributions begin?Payroll deductions will begin July 1, 2025 for employers participating in the State Plan. Those first payroll deductions from workers and employers will then be submitted to the State by October 2025.

Did the implementation dates change?Yes. A bill passed in April 2024 changed the timeline.

Will I be required to make and collect contributions for my employees who live in Maryland but work in another state?

No, eligibility and contributions are dependent on working in Maryland.

Will I be required to make and collect contributions for my employees who work in Maryland but live in another state?Yes, anyone working in a position located in Maryland will contribute. When will workers begin receiving benefits?Benefits will become available on July 1, 2026.

Why will contributions begin before benefits?The contributions employers will remit to the State will create a trust fund. The fund will grow over time and be ready to pay out benefits to Maryland workers starting July 1, 2026. What reporting requirements will there be?You will be responsible for filing quarterly wage and hour reports with the Division. These reports will be the basis for calculating the amount due each quarter. Even if you participate in a private plan, you will be required to file these reports. How will a worker apply for paid family and medical leave? How will employers remit payments?An online portal that workers, employers, and the FAMLI Division can access is under development. How is Maryland's family and medical leave insurance (FAMLI) program different from the Federal Medical Leave Act (FMLA)?

FAMLI and FMLA are similar in many ways, however the biggest difference is that FAMLI offers paid time off while FMLA ensures workers have access to unpaid time off. Also, FAMLI’s eligibility rules include more employees and the self-employed. When an event qualifies for leave through both FMLA and FAMLI, the leaves should run at the same time. There will be limited cases when an event only qualifies for FAMLI. In that case, an individual does not use any FMLA time while taking FAMLI. Maryland already requires paid sick days. How is FAMLI different?Paid sick days and FAMLI serve different purposes. It's not a perfect comparison, but one way to think about it is that paid sick days are for everyday colds. FAMLI is for battling a serious illness. When will I be required to notify employees about paid family and medical leave?You will be required to notify employees about paid family and medical leave: - six months before benefits begin,

- when the employee is hired,

- once a year,

- when the employee requests paid leave, and

- when you know that an employee's leave request may qualify.

What if I already offer paid family and medical leave?If you offer a plan with benefits that are equal to or better than the State Plan, you will be able to seek approval for your self-insured plan. More information about this process is forthcoming. How much will I contribute?

For those enrolled in the State Plan: For employers with 15 or more workers: The rate will be 0.90% of covered wages up to the Social Security cap, and will be equally divided between workers and employers. For employers with 14 or fewer workers: Employers are not required to contribute but will still collect the 0.45% payments from their workers. Employers may choose to cover part or all of their workers' contributions. While the Department of Labor sets the contribution rate for the State Plan, private plans will set their own rates. Workers cannot be charged more in a private plan than they would be through the State Plan. If I select the State Plan, do I have to make contributions for workers who are not eligible for benefits?Yes, contributions to the State Plan are required for all workers in Maryland, regardless of whether they are currently eligible for benefits.

|

What to Know About Medicare Part D PremiumsHow is the Part D benefit changing for 2025? The Inflation Reduction Act includes a number of changes to the Medicare Part D drug benefit, including a new $2,000 cap on out-of-pocket drug spending in 2025 for enrollees in Medicare Part D plans. It also requires Part D plans and drug manufacturers to pay a greater share of costs for Part D enrollees with drug costs in the catastrophic coverage phase (above the $2,000 spending cap) and reduces Medicare’s reinsurance liability. The law also eliminates the coverage gap phase as of 2025, where enrollees are currently responsible for paying 25% of their drug costs, drug manufacturers provide a 70% price discount on brand-name drugs, and plans pay 5% of costs. The Inflation Reduction Act includes a number of changes to the Medicare Part D drug benefit, including a new $2,000 cap on out-of-pocket drug spending in 2025 for enrollees in Medicare Part D plans. It also requires Part D plans and drug manufacturers to pay a greater share of costs for Part D enrollees with drug costs in the catastrophic coverage phase (above the $2,000 spending cap) and reduces Medicare’s reinsurance liability. The law also eliminates the coverage gap phase as of 2025, where enrollees are currently responsible for paying 25% of their drug costs, drug manufacturers provide a 70% price discount on brand-name drugs, and plans pay 5% of costs.

As of 2025, once enrollees have met their deductible (if their plan includes one), they will enter the initial coverage phase, where they will face cost sharing of 25% under the standard benefit (as in 2024), manufacturers will provide a 10% price discount, and Part D plans will pay 65% (Figure 1). Once enrollees reach the out-of-pocket spending cap and enter the catastrophic coverage phase, plans will be required to pay 60% of drug costs, up from 20% in 2024, and drug manufacturers will be required to provide a 20% price discount on brand-name drugs. Medicare’s share of total costs in the catastrophic phase will decrease from 80% to 20% for brand-name drugs and from 80% to 40% for generic drugs. Although Part D plans will be taking on additional liability for high drug costs in 2025, Medicare will continue to limit their liability for higher-than-expected drug costs through risk corridors, a risk sharing mechanism that has been in place since the Part D program started in 2006. In addition, CMS is launching a new voluntary demonstration to provide enhanced risk-corridor protection against overall losses for participating stand-alone PDPs to help stabilize the market

|